The stock market has played a major role in shaping the global economy. Over the years, several key events have influenced its growth. Notable milestones include the formation of the NYSE in 1817, the creation of the S&P 500 in 1957, and the rise of electronic trading.

These milestones have revolutionized how people invest and trade. In this blog post, we will explore these important events in detail and understand their impact on the financial world.

The Formation of the NYSE in 1817

The New York Stock Exchange (NYSE) was established in 1817 and has since become one of the most important financial institutions in the world.

The Early Days of NYSE

Before the NYSE was formed, stock trading was informal and lacked regulation. The Buttonwood Agreement of 1792, signed by 24 brokers, laid the foundation for organized trading. In 1817, the brokers formalized their operations by creating the NYSE.

Growth and Expansion of NYSE

Over the years, the NYSE grew rapidly as more companies listed their stocks. Some key events that contributed to its growth include:

- The introduction of the telegraph for faster communication in the 19th century.

- The inclusion of major companies such as General Electric and Ford in the early 20th century.

- The shift to digital trading platforms in the 21st century.

Impact of the NYSE Formation

The creation of the NYSE brought several benefits to the financial system, including:

- Increased liquidity: Investors could easily buy and sell shares.

- Price transparency: Stock prices became more reliable.

- Standardization: Trading rules and regulations ensured fairness.

Learn more about the history of NYSE

The Creation of the S&P 500 in 1957

The S&P 500 Index, introduced in 1957, is a key benchmark for the U.S. stock market. It tracks the performance of 500 large companies across various sectors.

Why Was the S&P 500 Created?

Before 1957, investors relied on smaller indices to measure market performance. The S&P 500 was introduced to provide a broader, more accurate picture of the stock market.

Key Features of the S&P 500

- Diverse Selection: The index includes companies from different sectors such as technology, healthcare, and finance.

- Market Capitalization Weighting: Larger companies have a greater impact on the index value.

- Reliable Benchmark: It is widely used by investors and analysts to track market trends.

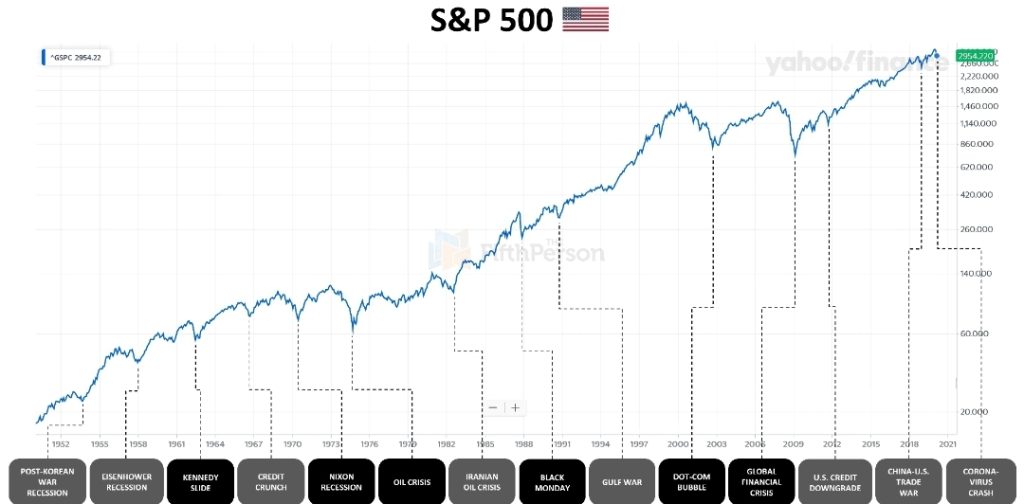

Performance Over the Years

The S&P 500 has grown significantly, reflecting the expansion of the U.S. economy. Some major milestones include:

| Year | Notable Event |

|---|---|

| 1987 | Market crash (Black Monday) |

| 2000 | Dot-com bubble burst |

| 2008 | Global financial crisis |

| 2020 | COVID-19 pandemic market fluctuations |

Why the S&P 500 Matters Today

The S&P 500 helps investors by providing insights into market health and guiding investment decisions. Many mutual funds and ETFs track this index.

The Rise of Electronic Trading

The rise of electronic trading has transformed the stock market, making it faster and more efficient.

What Is Electronic Trading?

Electronic trading refers to the use of digital platforms to buy and sell stocks instead of traditional physical exchanges.

Key Developments in Electronic Trading

Some of the major advancements in electronic trading include:

- 1971: The launch of NASDAQ, the first electronic stock market.

- 1990s: Introduction of high-frequency trading (HFT) to execute trades in milliseconds.

- 2000s: The rise of online brokerages like E*TRADE and Robinhood.

Advantages of Electronic Trading

Electronic trading has provided numerous benefits to investors, such as:

- Speed: Transactions are completed in seconds.

- Lower Costs: Reduced fees compared to traditional brokers.

- Accessibility: Anyone with an internet connection can trade.

Challenges of Electronic Trading

Despite its benefits, electronic trading has some challenges:

- Cybersecurity risks: Hackers can target trading platforms.

- Market volatility: High-speed trading can lead to rapid market fluctuations.

The Future of Electronic Trading

The future of electronic trading looks promising, with trends such as:

- Artificial Intelligence (AI): AI is being used to analyze market trends.

- Blockchain Technology: It offers secure and transparent transactions.

- Mobile Trading: More people are trading using smartphones.

Comparison of NYSE, S&P 500, and Electronic Trading

The table below compares these three major milestones:

| Milestone | Year | Key Feature | Impact |

|---|---|---|---|

| NYSE Formation | 1817 | Organized stock trading | Increased market regulation |

| S&P 500 Creation | 1957 | Broad market index | Helps in investment decision-making |

| Electronic Trading | Ongoing | Digital transactions | Faster and more cost-effective trading |

Conclusion

The stock market has come a long way since its early days. The formation of the NYSE in 1817, the creation of the S&P 500 in 1957, and the rise of electronic trading have all played a significant role in shaping modern financial markets.

These milestones have improved market efficiency, transparency, and accessibility for investors worldwide. As technology continues to evolve, we can expect even more innovations in the financial industry.

If you’re interested in investing, understanding these milestones can help you make informed decisions and navigate the market with confidence.

What do you think is the most important milestone in stock market history? Share your thoughts in the comments!